dupage county sales tax vs cook county

If your Property Taxes are Sold at the Annual Tax Sale Held on November 1718 2022. What is the sales tax on a car in Cook County IL.

County And Municipal Cannabis Sales Taxes Go Into Effect July 1 The Civic Federation

Some cities and local governments in Dupage County collect additional local sales taxes which can be as high as 425.

. If youre looking to buy a house the two big numbers youll want to. Side-by-side comparison between Cook county IL and DuPage county IL using the main population demographic and social indicators from the United States Census. I am in Dupage and.

Thanks to the DuPage County sales tax reduction the new rate for services and parts is 75 and the new rate for cars is 7. 1337 rows Lowest sales tax 625 Highest sales tax 115 Illinois Sales Tax. So if a county website says the average tax rate for the county is 75 per hundred dollars of value a builders sales rep will probably say that the rate is 25 25 per hundred dollars of.

By Annie Hunt Feb 8. Recently I looked online at a 2 flat in a Cook County suburb and nearly fell out of my chair when the real estate agent told me what the property taxes were. Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the.

Thanks to the DuPage County sales tax reduction the new rate for services and parts is 75 and the new rate for. 2 days agoUpdated 8312022 929 AM. Dupage county vs cook.

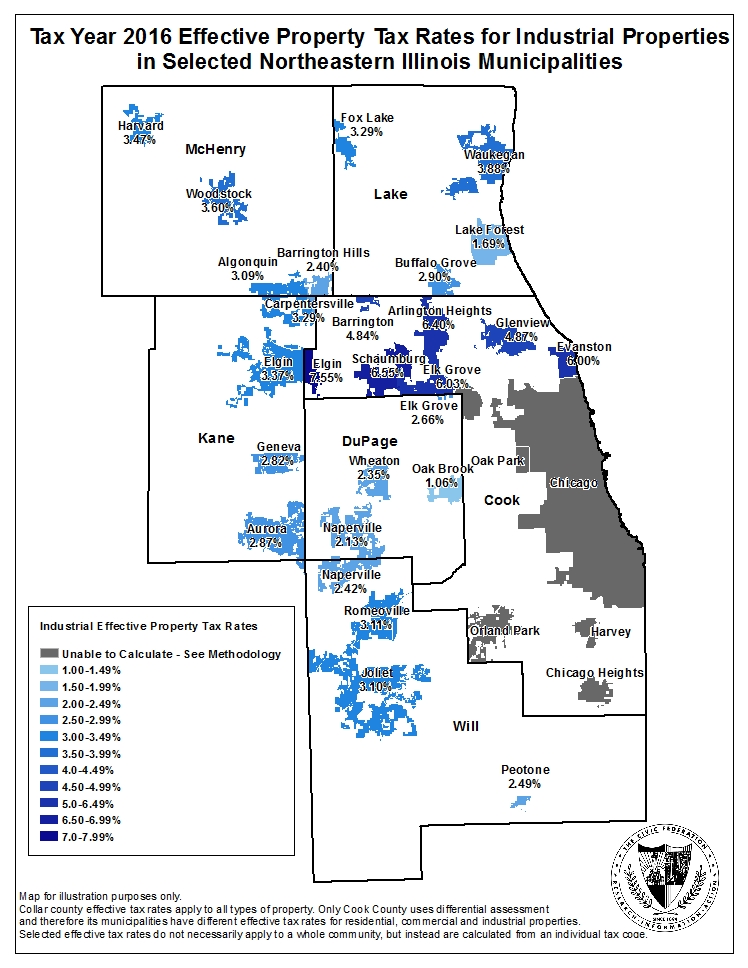

Sales Taxes The base sales tax rate in DuPage County is 7 7 cents per 100. Dupage county vs cook county1959 nascar standings dupage county vs cook county. At the time the average rate for Cook County including municipal sales tax was about 216 percentage points higher than in DuPage Kane Lake McHenry and Will counties.

Income tax revenues are trending up but sales tax. These rates were based on a tax hike that dates to 1985. DuPage County is expected to amass a 40 million budget surplus by the end of the fiscal year.

At the time the average rate for Cook County including municipal sales tax was about 216 percentage points higher than in DuPage Kane Lake McHenry and Will counties. The Illinois sales tax of 625 applies countywide. The base sales tax rate in DuPage County is 7 7 cents per 100.

Cook has higher sales taxes but both Cook and DuPage have higher property taxes depending on which town youre in. PLEASE CONTACT THE DU PAGE COUNTY CLERK AT 630-407-5500 for an Estimate of Redemption. Keep in mind that low property tax rates dont mean a county is the best place to invest in nor do high property tax rates mean a county should be out of the running.

North Central Illinois Economic Development Corporation Property Taxes

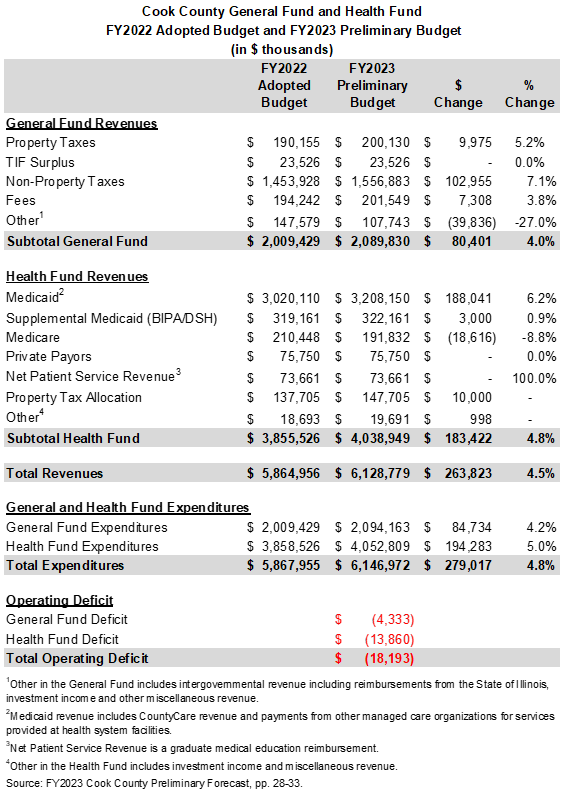

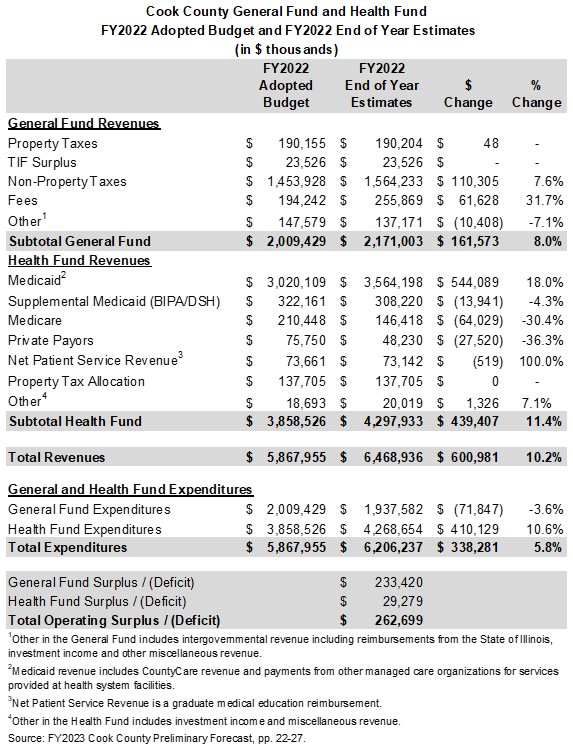

Cook County Forecasts Operating Surplus For Year End Fy2022 And Small Deficit Heading Into Fy2023 The Civic Federation

Cook County Forecasts Operating Surplus For Year End Fy2022 And Small Deficit Heading Into Fy2023 The Civic Federation

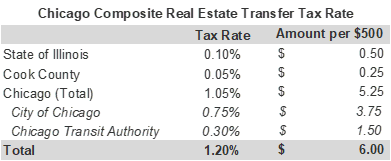

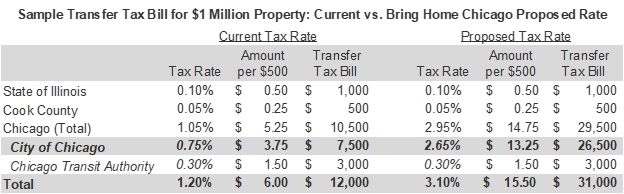

Chicago Referendum Campaign Launched To Increase Real Estate Transfer Tax On Multimillion Dollar Properties The Civic Federation

Chicagoland Il Area Counties 2020 2nd Installment Property Tax Due Dates Chicagoland Mchenry Property Tax

Chicago Referendum Campaign Launched To Increase Real Estate Transfer Tax On Multimillion Dollar Properties The Civic Federation

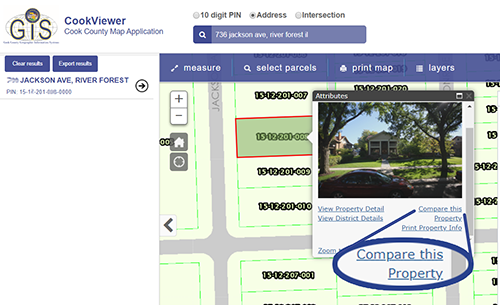

Find Comparable Properties Cook County Assessor S Office

Estimated Effective Property Tax Rates 2007 2016 Selected Municipalities In Northeastern Illinois The Civic Federation

The 2021 Crop Insurance Loss Performance Farmdoc Daily

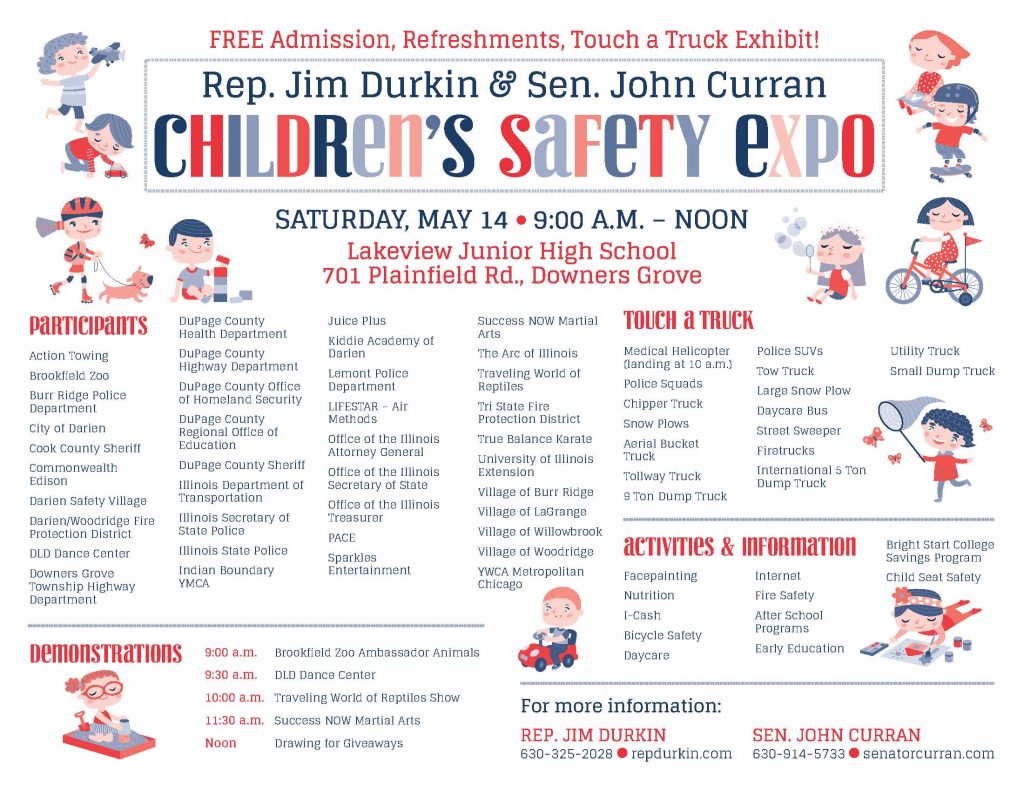

House Minority Leader Jim Durkin Sen John Curran To Host Free Kids Health Safety Expo On May 14 John Curran

Find Comparable Properties Cook County Assessor S Office

Chicago Il Property Tax Rate Outlet 60 Off Www Quadrantkindercentra Nl